Technical Article

How the Inflation Reduction Act Unlocks Middle-Market Solar

We’ve all seen the headlines by now. From “[The] U.S. solar market expected to triple in size in five years” to “The South is building the most vibrant EV and battery hub in the US” the PV and energy storage industries are quickly mobilizing to meet the growing market demands following the passage of the Inflation Reduction Act (IRA) last August.

While the accuracy of forward-facing projections may be up for debate, the sheer size of what the Department of Energy refers to as “the single largest investment in climate and energy in American history” is enough to justify the excitement.

Quick aside: For those unfamaliar with the IRA, the bill was signed into law last summer and injects hundreds of billions of dollars into solar PV, energy storage, and other low-carbon technologies over the next decade. IRA funds incentivize domestic manufacturing and lock in generous tax credits which are now transferable. Check out our recent Ask Mayfield Anything webinar on the IRA for a more thorough overview.

A rising tide (in the form of $370 billion) raises all boats. But historically speaking, some of those boats were cruise ships while others were kayaks. In this post, we will focus on the forgotten middle markets – the kayaks among the cruise ships, or, in our case, the meaty middle between the residential rooftop and large-scale utility PV markets.

What are solar middle markets?

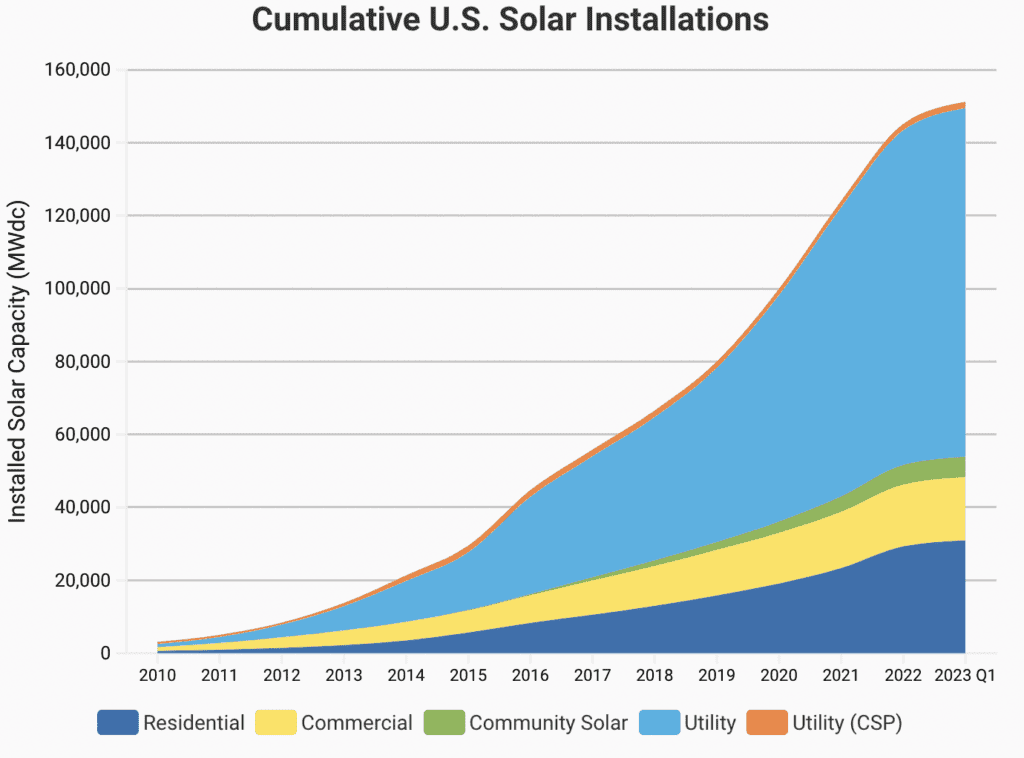

The residential and utility-scale solar markets have been pillars of the industry going back to the early 2010s, scaling quickly, even in the face of a once-in-a-century pandemic. Per Solar Energy Industries (SEIA) data, the residential solar market experienced its sixth consecutive record year in 2022, while Q1 utility-scale deployments broke records in 2023.

Residential projects have benefited from having a large target market (American homeowners with sunny roofs) with a wide range of motivations (financial ROI, energy independence, reduced carbon footprint, etc). With only a utility bill and a view of the roof, a residential contractor can quickly generate a sales proposal. While certainly not simple, typical residential systems are easier to design and install at scale than middle-market projects.

Meanwhile, utility projects have taken advantage of economies of scale. Larger purchase orders reduce component costs on a per-watt basis. Utility-scale solar deployment also follows a cyclical learning curve: a decline in price causes an increase in deployment and an increase in deployment causes a drop in price. As more utility-scale projects are installed, the industry becomes more efficient at installation and prices drop. This isn’t a firm rule, but a long-term pattern unique to specific innovative technologies.

Between the residential and utility-scale markets is an often overlooked middle ground consisting of rooftop C&I, carports, community solar, and microgrid projects. In this space, the motivation for going solar is often financial, and payback periods are heavily dependent on incentives and utility rate structures. For example, a warehouse owner in California may pay twice as much in demand charges as a warehouse owner in South Carolina. Solar PV alone cannot reliably guarantee demand charge savings. Pairing solar PV with energy storage introduces valuable peak-shaving and time-of-use optimization capabilities but greatly increases upfront costs. All of these factors combine to make the middle-market sales process challenging.

Middle-market projects also require a higher degree of customization across the entire design and installation process. A ballasted rooftop array atop a library, a carport shading a grocery store parking lot, and a ground-mounted community solar array next to a hospital would all fall into the middle-market category but would require drastically different components. There is no cookie-cutter PV system at the C&I scale.

In short, the higher degree of customization and dependence on ROI has led to slower growth for middle markets. But that trend is poised to change with the passage of the IRA.

What impact will the Inflation Reduction Act have?

If you’ve ever attended a solar industry conference, you may have heard the term “solar coaster” thrown around. Industry veterans will tell you that working in solar over the past decade has indeed felt like a roller coaster ride, as technologies seemingly innovate overnight while codes and standards are always evolving to keep pace. Underneath it all, federal policies have the power to quickly ignite or extinguish demand through incentives, subsidies, and tariffs.

The power of federal policies and political will is difficult to overstate. Historically, the ebbs and flows of solar and energy storage demand have more or less been tethered to the availability of government incentives. As new tax credits are offered, demand rises. As the threat of tariffs increases, demand drops. The cycle is in sync with the highly polarized American political system, meaning each election has downstream impacts on project financing and risk.

The IRA provisions seek to minimize “solar coaster” risks by outlining a decade of legislative consistency that stretches into the 2030s. Existing tax credits were extended for many years, and new credits were added to boost emerging markets. In addition, IRA provisions introduce new financing mechanisms that should make it easier for middle-market projects to find private investors or affordable loans. Let’s take a closer look at some of the key provisions aimed at boosting the middle market.

A decade of full-value tax credits brings stability

Solar industry veterans are likely familiar with the investment tax credit (ITC), which since 2005 has covered up to 30% of system costs. The ITC has been closely tied to political headwinds, with tax credit extensions and sunsets being reset every few years. The IRA will reverse this trend, steadying the solar coaster by locking in the full-value ITC for a decade. The ITC can now be applied to standalone energy storage projects in addition to standalone PV or PV paired with storage.

The IRA also unlocks the production tax credit (PTC) for solar PV projects. Previously, the PTC was only available for wind projects. Now, PV asset owners can elect to receive production payments for the first 10 years of plant operation in lieu of the ITC. Choosing between the ITC and PTC will be an economic calculation that will vary on a project-by-project basis.

Bonus tax credits make projects even cheaper

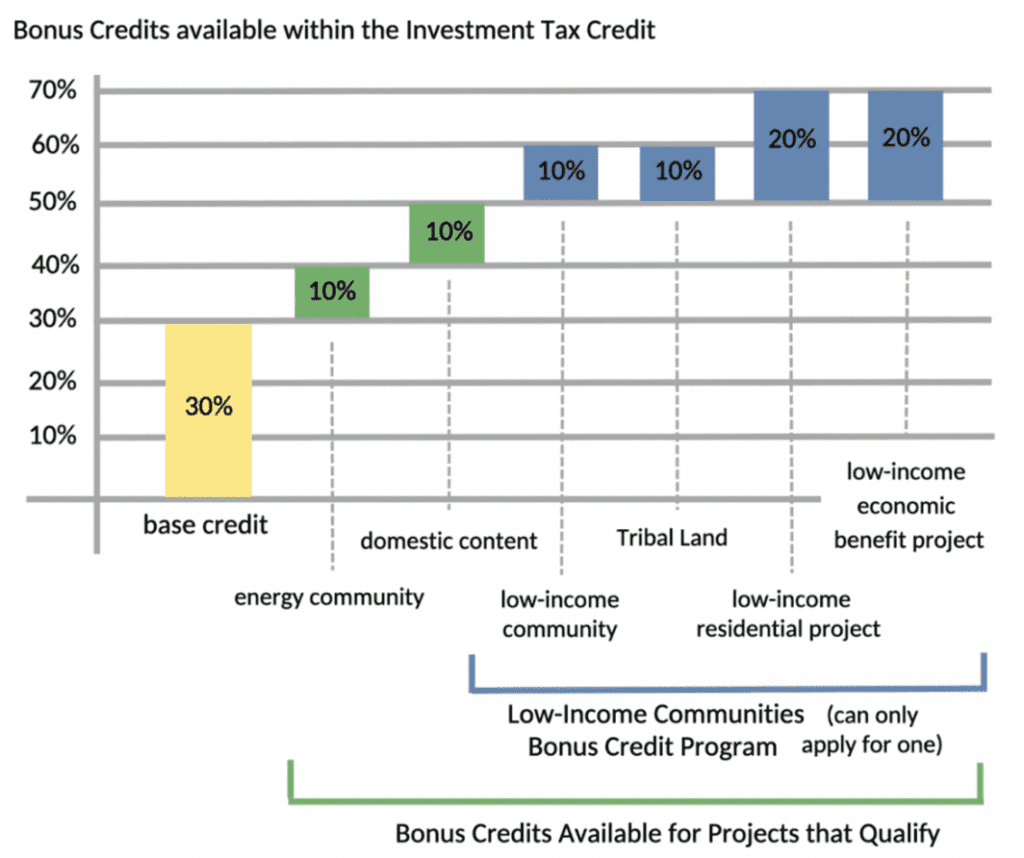

Bonus tax credits are now available through the IRA, in addition to the baseline ITC and PTC credits. Each bonus credit adds as much as 10% to the baseline ITC or PTC values and can be stacked to cover up to 70% of project costs.

- +10% domestic content bonus credit for projects with >40% domestic components (as calculated by total component cost, excluding labor).

- +10% bonus credit for projects located in energy communities.

- +10% bonus for projects in low-income or tribal communities, which increases to +20% if the facility is part of a qualified low-income economic benefit project such as a community solar array serving primarily low-income customers.

A 70% tax credit is now achievable and specifically targets community solar projects. A 60% tax credit is achievable for other middle-market projects such as rooftop C&I, which previously struggled to pencil out.

Transferability unlocks new financing mechanisms

Up to this point, system owners needed tax liability to make use of the tax credits they received. Moving forward, IRA provisions allow tax credits to be sold to unrelated parties for cash. Transferability will greatly expand the overall investment pool, which should attract more private investors and generate new opportunities for projects installed by nonprofits and other non-tax-paying entities. Consult your tax advisor or CPA for more information on tax credit transfers.

The Solar Decade is upon us. Provisions in the IRA will supercharge an already fast-growing industry, including targeted support for the historically-overlooked middle markets. If you are focused on the burgeoning solar middle market, Mayfield Renewables is right there with you. Connect to learn more about our system design and consulting services.