Technical Article

Top 3 Reasons ESS Makes Commercial PV Cost-Effective

Depending on where you are in the country, integrating energy storage systems (ESS) with commercial solar photovoltaic (PV) systems offers significant financial benefits. ESS can enhance the cost-effectiveness of solar energy through strategies like energy arbitrage, peak demand reduction, and avoiding PV export penalties. These advantages lead to substantial savings and improve the overall return on investment for commercial solar installations. In this article, we explore the top three reasons why ESS makes commercial PV systems more cost-effective.

1. Arbitrage and Time-of-Use (TOU) Offset

Arbitrage is a key financial strategy that leverages the timing of energy usage to maximize cost savings. Businesses with energy storage can store excess energy produced by PV arrays onsite when supply outpaces demand or charge the energy storage with grid electricity when rates are low. This stored energy can then be dispatched during times of high demand or high TOU rates (which typically occur in the evening or during peak business hours) to avoid the steep costs associated with these peak periods.

In an interview for this article, Yotta Energy’s Mitch Sargent gave the following use cases for commercial arbitrage: “Consider a bakery that starts its day before the sun comes up. The business owner could program the battery to dispatch in the early morning as the kitchen ramps up. Or perhaps the end client is a large industrial facility with multiple shifts. In that case, you could size an ESS for arbitrage to offset the nighttime usage and power the daytime shifts mostly with PV.”

In California, the evening TOU rates can be 10-30% higher than off-peak rates (10:00 am to 2:00 pm), making arbitrage's financial benefits substantial. Businesses can drastically reduce their electricity bills using stored energy during these expensive periods. This strategy is particularly effective for businesses with fluctuating energy needs, such as manufacturing plants, hospitals, healthcare facilities, commercial offices, retail stores, and warehouses or distribution centers. For example, a manufacturing plant could program its ESS to discharge when grid electricity rates are highest and to charge from onsite solar or the grid when rates are more affordable.

Through arbitrage, Californians can also mitigate the impact of new net energy metering (NEM) policies, such as NEM 3.0, which offers lower credits for excess energy exported to the grid. By storing and using this energy on-site, businesses can avoid the reduced financial returns from exporting solar power. This maximizes the use of generated solar energy and increases the overall return on investment for the PV system.

2. Peak Demand Reduction

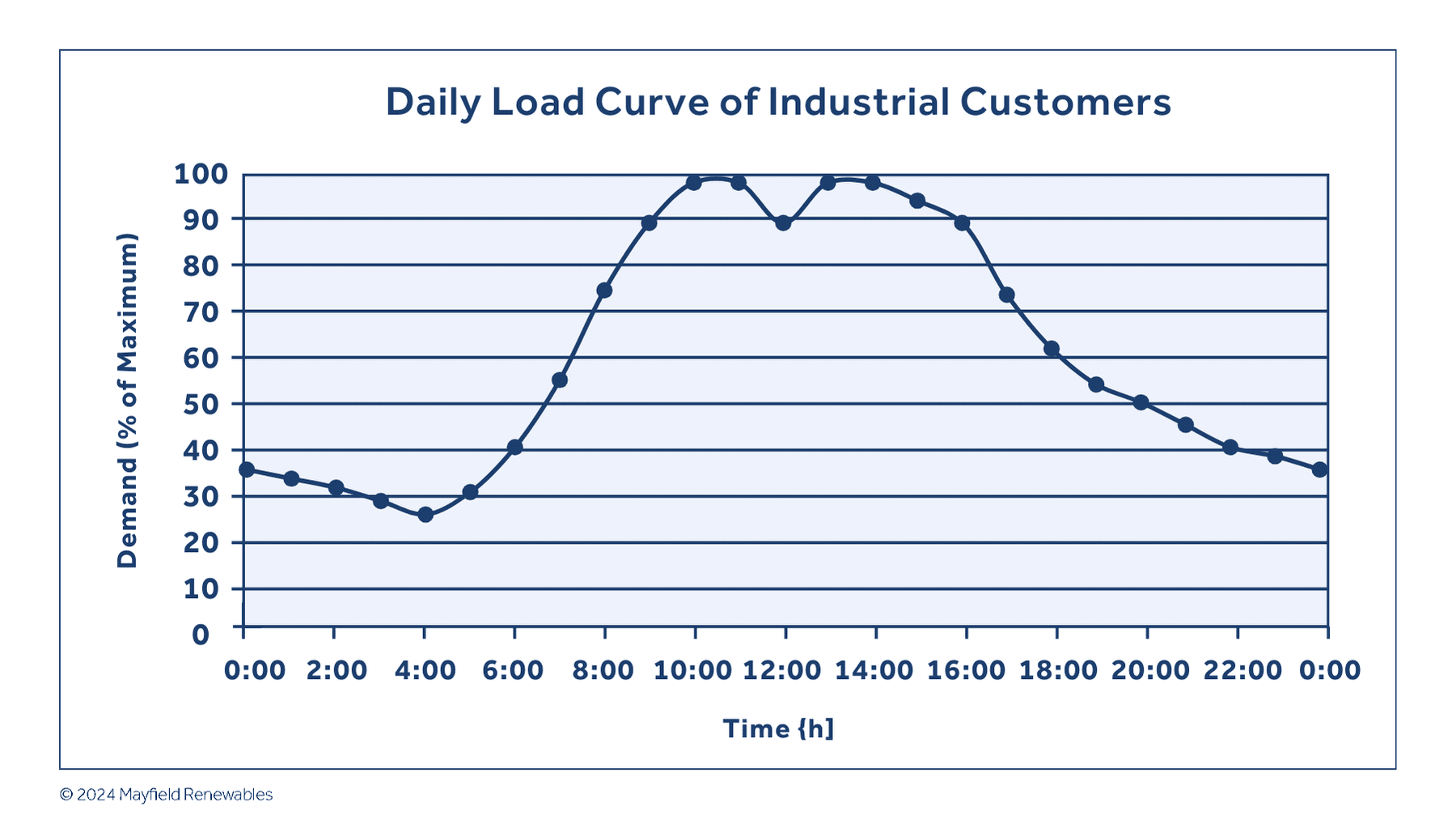

Peak demand charges are a significant component of commercial electricity bills, often resulting in substantial costs for businesses with intermittent high power usage. These charges are based on the highest 15-minute interval power demand within a billing cycle. Peak demand rates incentivize business owners to have consistent demand throughout the workday, which is challenging, if not impossible, without energy storage.

A properly sized and programmed ESS allows business owners to strategically discharge their batteries when their facility demand is approaching peak levels, effectively flattening the demand curve. For facilities with equipment that pulls significant power intermittently—such as medical facilities with MRI machines that cycle on and off throughout the day—peak shaving can provide dramatic cost reductions. By smoothing out demand peaks, the ESS ensures the facility does not incur high demand charges, leading to a quicker payback than PV-only systems.

Moreover, reducing peak demand can qualify businesses for more favorable utility rate plans, further enhancing cost savings. For instance, by lowering peak demand to a certain threshold, businesses may be able to switch to a lower-cost tariff. This is particularly beneficial in regions with tiered rate structures, where small reductions in peak demand can result in substantial savings.

Peak demand reduction through energy storage cuts costs and enhances a business's overall energy management strategy. It provides greater predictability and control over energy expenses, helping businesses manage their budgets and operational costs better. This strategic advantage is crucial for businesses with varying operational demands and helps them optimize their energy usage patterns to achieve maximum efficiency and cost-effectiveness.

3. Avoidance of PV Export Penalties and Increased ROI

With recent changes in net metering policies, particularly in regions like California, such as the introduction of NEM 3.0, the financial benefits of exporting excess PV generation to the grid have significantly diminished. Under these new rules, the compensation for exported solar energy has been reduced, making it less financially attractive for businesses to rely on traditional net metering alone. This shift necessitates a strategic approach to maximize the value of generated solar energy, and integrating ESS provides an effective solution.

Energy storage systems allow businesses to store surplus solar energy that would otherwise be exported to the grid at a lower rate or without compensation under the new NEM 3.0 rules. By storing this excess energy, businesses can use it during periods when their solar arrays are not generating electricity, such as during the evening or on cloudy days. This self-consumption approach ensures that the electricity produced by the PV system is used more efficiently, avoiding the financial penalties associated with reduced export credits.

Furthermore, ESS enables businesses to time-shift their energy usage, utilizing stored solar energy during peak rate periods when electricity prices are highest. By aligning energy usage with periods of highest need and cost, businesses can reduce reliance on the grid and achieve a higher return on investment (ROI) from their PV systems.

Precise sizing of the ESS plays a crucial role in optimizing its cost-effectiveness. Customizing the ESS to the specific energy needs and load profiles of the business ensures that the system is neither undersized nor oversized. This tailored approach minimizes capital expenditure (CapEx) while maximizing lifetime savings and ROI. Sizing energy storage systems through iterative feasibility studies is one of the many services our engineering team provides.

4. Bonus - Meeting Sustainability Goals

Lastly, the ability to store and use solar energy on-site enhances the overall sustainability profile of the business. By reducing reliance on grid electricity and minimizing wasted energy, businesses contribute to environmental sustainability goals and achieve economic benefits. This dual advantage strengthens the case for integrating ESS with commercial PV systems, making it a prudent investment for forward-thinking businesses. It can also act as a powerful marketing tool — businesses with (solar-plus-) energy storage can tout their low carbon footprint.

Conclusion

Integrating ESS with commercial PV systems offers significant financial advantages, making it a critical component for businesses aiming to optimize their energy costs. ESS maximizes the economic benefits of solar energy installations through effective energy arbitrage, substantial reduction in peak demand charges, and avoiding penalties associated with PV exports. This integration enhances the return on investment and ensures businesses adapt to evolving utility rate structures and market conditions. As advancements in battery technology continue to drive down costs and improve efficiency, the adoption of ESS in commercial PV systems is set to become even more compelling, providing a sustainable and cost-effective energy solution for the future.

Are you looking for an engineering partner who can navigate consulting on product selection and value engineering opportunities? Reach out to discuss how we can support your team today.